Over the upcoming months leading up to the Contact Summit in October, I’ll be highlighting various projects and initiatives working to construct a globally networked society. As humanity and technology co-evolve into higher orders of complexity, it can be said that social media is now facilitating the emergence of new forms of culture, commerce, and governance. We want to bring attention to the great and liberating stuff that’s happening, and encourage connections, conversation, and collaboration.

Over the upcoming months leading up to the Contact Summit in October, I’ll be highlighting various projects and initiatives working to construct a globally networked society. As humanity and technology co-evolve into higher orders of complexity, it can be said that social media is now facilitating the emergence of new forms of culture, commerce, and governance. We want to bring attention to the great and liberating stuff that’s happening, and encourage connections, conversation, and collaboration.

The past few weeks have been focused on technology infrastructure, starting with the Towards A Distributed Internet post and the resource list of mesh networks, and continuing on with the formation of a Next Net google group that’s thriving with over 90 members already!

We’ll continue to circle back and revisit conversations and progress, but for now I’ll move on to another hot topic: money and value exchange.

What is the future of money? And not just money, but currencies in general – from virtual currencies to timebanks to social currencies based around trust, identity, reputation, expertise and relationships. And not just currencies, a.k.a. tools that are supposed to represent a unit of measurement in order to transact, but also value exchange in general and the social behaviors that precede them.

So we’re really talking about The Superfluid Economy, the set of tools and behaviors that are developing to make economic exchange, transactions, payments, commerce, distributed collaboration, resource allocation, and social enterprise formation as frictionless and fluid as possible.

To kick off the conversation, I pulled up 10 projects that are innovating in this space which are either developing new products and services, or raising awareness through art and media. We’re excited to know that some of the initiatives below will be represented at Contact!

“We will not have an equitable nor a healthy economy in an information age, until we have information technology which empowers us equitably — that is decentralized, peer-to-peer and operates by mutual agreement.”

This project gives a broad definition of currency as “a formal system used to shape, enable or measure currents.” Beyond money, they describe currency as a form of social DNA which shapes flows of attention, trust, participation and value. They seek to build the technology platforms and protocols that would allow people to transact directly with each other with no segment of that interaction relying on a centrally controlled system.

Here’s a nice prezi they created to create a framework for this thinking:

on twitter: @metacurrency

“By offering economic tools, to enable real-world and virtual communities to declare their own localised currencies, and to trade in them using open source software, thus building a more sustainable economy for the 21st century.”

Starting with a LETS architecture coded into the Drupal platform, CommunityForge enables communities to create free digital currencies in order to barter, coordinate activities within an organization, exchange value, and build local resilience.

3. Bitcoin

Bitcoin is a peer-to-peer digital currency. Peer-to-peer (P2P) means that there is no central authority to issue new money or keep track of transactions. Instead, these tasks are managed collectively by the nodes of the network.

Bitcoin is an open source project currently in beta development stage, being used by between 5-10K people around the world. Here’s a list of sites that accept bitcoin as payment, and a short video that explains more about it:

on twitter: @bitcoinmedia

4. Symbionomics

“The story we are telling is one of hope and new possibility. While many conventional institutions are crumbling, in this moment there is a unique chance for humanity to fundamentally reinvent its presence on this planet.”

Symbionomics is a collaborative media project exploring the trends and patterns that are contributing to the formation of a new economic structure. They’ll be making videos, infographics, and animations over the next year which distill these big ideas into shareable and useful information. Here’s their intro video:

on twitter: @symbionomics

5. Payswarm

“The PaySwarm web platform is an open standard that enables web browsers and web devices to acquire licenses, distribute micropayments and perform copyright-aware digital media distribution.”

Payswarm is a patent and royalty-free micropayment and content distribution platform, and plans to become an official World Wide Web Consortium (W3C) standard. They seek to make it easier for digital content (images, music, video, and data) to be promoted, distributed, and purchased. Here’s their intro:

on twitter: @payswarm

6. Ripple

“Ripplepay.com is a payment system where everyone is a banker. Connect to your friends, family, and associates and your credit with them becomes a fully-functional currency.”

Inspired by the LETS system, Ripple tracks obligations between individuals in a social network. More:

7. OurGoods

“OurGoods exists so that creative people can help each other produce independent projects. More work gets done in networks of shared respect and shared resources than in competitive isolation.”

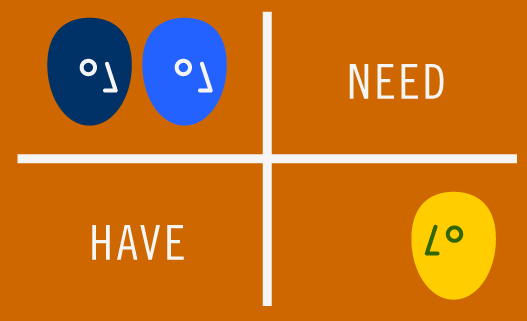

OurGoods supports the production of new work through barter, because resource sharing is the paradigm of the 21st century. OurGoods is a scaleable, local initiative and part of the growing landscape of alternative models of exchange in art, design, and culture. OurGoods is specifically dedicated to the barter of creative skills, spaces, and objects. It is a community of cultural producers matching “needs” to offered “haves”. OurGoods helps independent projects get done.

on twitter: @OurGoods

8. WingCash

“WingCash is a simple way for individuals and businesses to send and receive cash on the Internet.”

WingCash is a payment platform that operates like an in-person physical cash transaction; there is no transaction cost or fee for the buyer or the merchant. An individual or a business using WingCash receives the full value of the payment sent. More:

on twitter: @WingCash

“The Open Bank Project will define and produce API standards, open source software and a hardware appliance that can connect to bank systems and securely expose certain accounts’ data to authorized (may be public) users.”

The Open Bank Project is a European initiative to open up financial transactions to much larger groups of individuals and raise the bar of financial transparency. It will achieve this by allowing a diverse range of third-party software applications (including fraud analysis tools, web apps, mobile apps, social widgets and payment gateways) to access any bank account that supports the Open Bank Protocol and API. Once a bank supports the Open Bank Protocol, account holders could opt in to the protocol and choose which groups of users would have access to the account. Security will be assured by a combination of in-house security expertise and scrutiny from the open source community.

10. time/bank

“Through Time/Bank, we hope to create an immaterial currency and a parallel micro-economy for the cultural community, one that is not geographically bound, and that will create a sense of worth for many of the exchanges that already take place within our field—particularly those that do not produce commodities and often escape the structures that validate only certain forms of exchange as significant or profitable.”

time/bank is a platform where groups and individuals can pool and trade time and skills, bypassing money as a measure of value. Time/Bank is based on the premise that everyone in the field of culture has something to contribute and that it is possible to develop and sustain an alternative economy by connecting existing needs with unacknowledged resources.

__

Hope you enjoyed the roundup. Please add interesting projects I’ve missed

If you’d like to join the conversation around currencies or any of the other topics we plan to cover at Contact, please visit the Contact Summit google group.

thanks to @jeffsayre @webisteme @tek_fin @rsbohn @xanthm and @v17us for the #futureofmoney project suggestions

Venessa Miemis